No More SMS/OTP

Improve your customer’s account security with a better user experience that keeps them in your app, avoiding codes sent to emails or text messages.

Improve your customer’s account security with a better user experience that keeps them in your app, avoiding codes sent to emails or text messages.

Validate high-value transactions with biometric authentication, PIN verification, and encrypted NFC tap-to-sign security.

Instead of answering personal identification questions with your call center, customers simply open your banking app prompting them to tap to authenticate.

Avoid losing customer trust and revenue due to unnecessary payment rejections. Prevent them with instant, secure transaction verification.

Remove access points from nefarious actors with hardware passkey technology built into your payment cards – Powered by Arculus

Provide an easier authentication process when customers get new phones and payment cards with a tap.

Eliminate passwords with tap-to-authenticate security, enabling fast, frictionless login with multi-factor authentication

Enhance customer loyalty with a premium metal card that provides secure access, exclusive perks, and a seamless user experience.

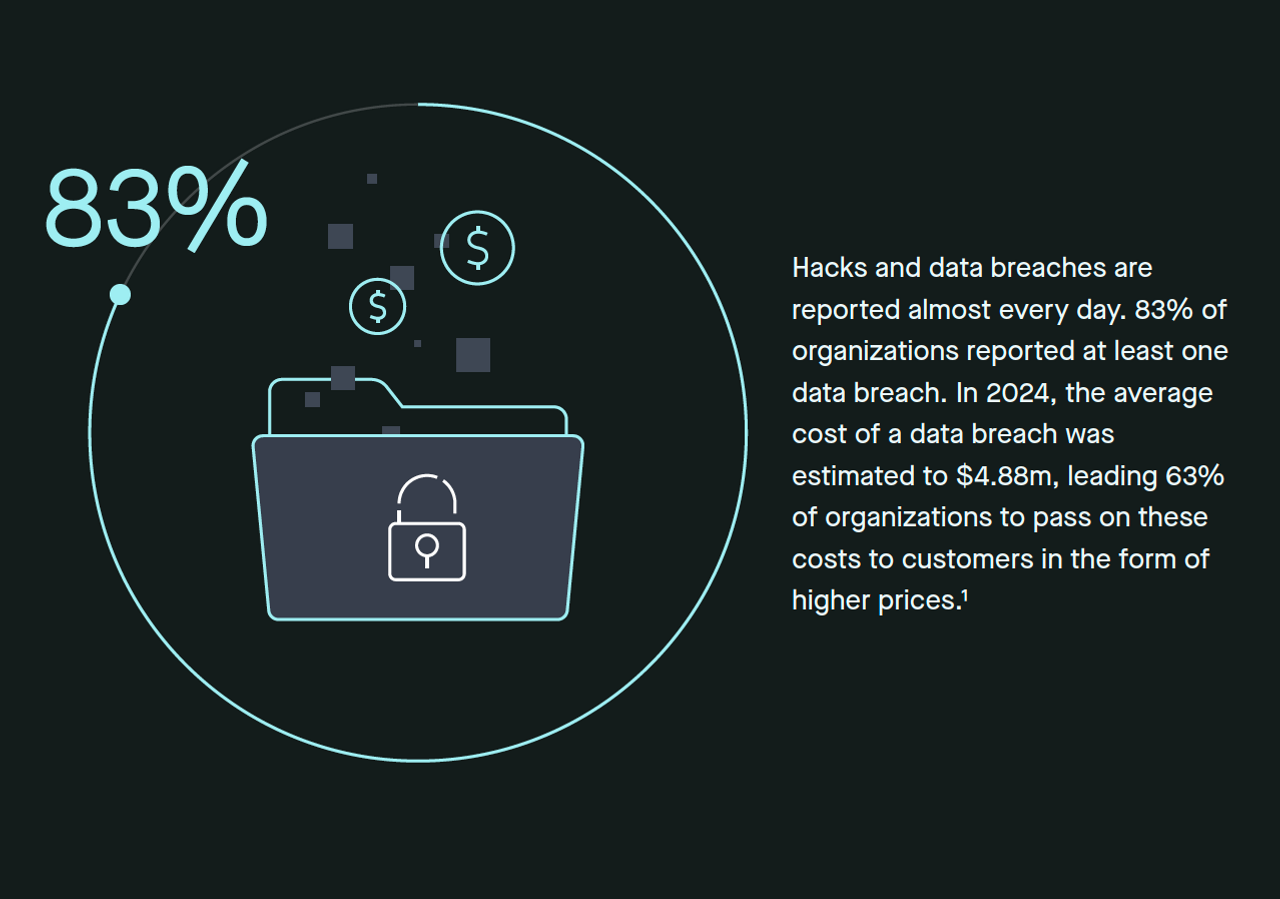

A seismic shift is transforming the digital security landscape, as the adoption of Fast Identity Online (FIDO) standards by leading tech giants like Apple, Google, and Microsoft marks a significant step forward in the fight against cyber threats.

In a world where data breaches and cyber threats are a daily occurrence, the shortcomings of traditional passwords have never been more evident. With 83% of organizations reporting breaches, it's clear that new approaches to authentication are needed.

Beyond Passwords: How Banks and Financial Firms Can Address Customer Security with Convenience